Estimate the present value of the tax benefits from depreciation

Estimate the present value of the tax benefits from depreciation. The equipment will have a depreciable life of five years and will be depreciated to a book value of 3000 using straight-line depreciation.

Tax Shield Formula Examples Interest Depreciation Tax Deductible

The cost of capital is 9 percent and the firms tax rate.

. Estimate the present value of the tax benefits from depreciation. Present value 14205905 01 The depreciation per year will be. You are free to use this image on your website templates etc Please provide us with an attribution link.

Id like a CPA. Estimate the present value of the tax benefits from depreciation. Present Value of Tax Benefits from Depreciation 062 c.

Neither bonus depreciation nor Section 179. For example if you have a cash flow of 15000 for a period and depreciation of 1000 for the. Round your answer to 2 decimal places Depr Ending Book Value - Beginning Book ValueLife of Asset 1033000 -.

The equipment will have a depreciable life of 7 years and will be depreciated to a book value of 200 using straight-line depreciation. If company XYZ has a depreciation expense of 50000 and the tax rate is 30. Depreciable basis Ending book value Depreciation Life of asset 912000 142000 10 years 77000 per year.

Estimate present value of tax depreciation claim for two types of equipment We sell a product that potentially offers a tax benefit in the US. Tax benefit 3000034 10200. Compared to competing products.

The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. Neither bonus depreciation nor Section 179. Your company is considering a new project that will require 100000 of new equipment at the start of the project.

For example company B buys a production machine for 10000 with a useful life of five years and a salvage value of 1000. Neither bonus depreciation nor Section 179. Tax Benefits from Expensing Asset Immediately 25 04 1 million.

To calculate the depreciation value per year first. Annual depreciation expense 250000 - 100008 30000. The equipment will have a depreciable life of 8 years and will be depreciated to a book value of 155000 using straight- line depreciation.

Annual depreciation expense 250000 100008 30000. The cost of capital is 10 and the firms tax rate is 30. Additional tax benefit from immediate expensing 1.

Estimate the present value of the tax benefits from depreciation. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. The annual depreciation would be computed first and then multiplied by 30 or 030 to find the annual tax savings from depreciation tax shield.

Tax benefit 30000 034 10200. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. Simply subtract the value of the depreciation from your cash flow for each period.

This reduces the tax it needs to pay by 280000. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating.

Return On Equity Roe In 2022 Return On Equity Equity Financial Analysis

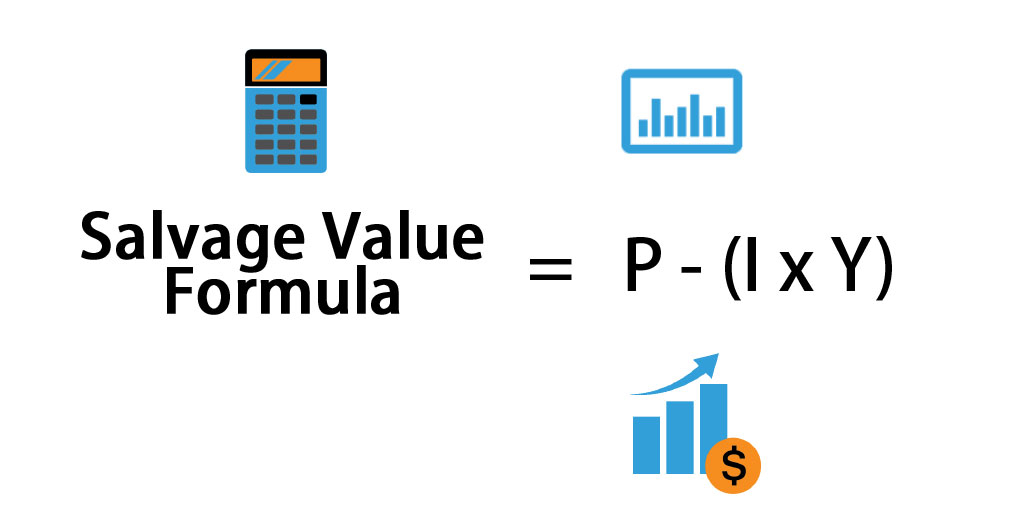

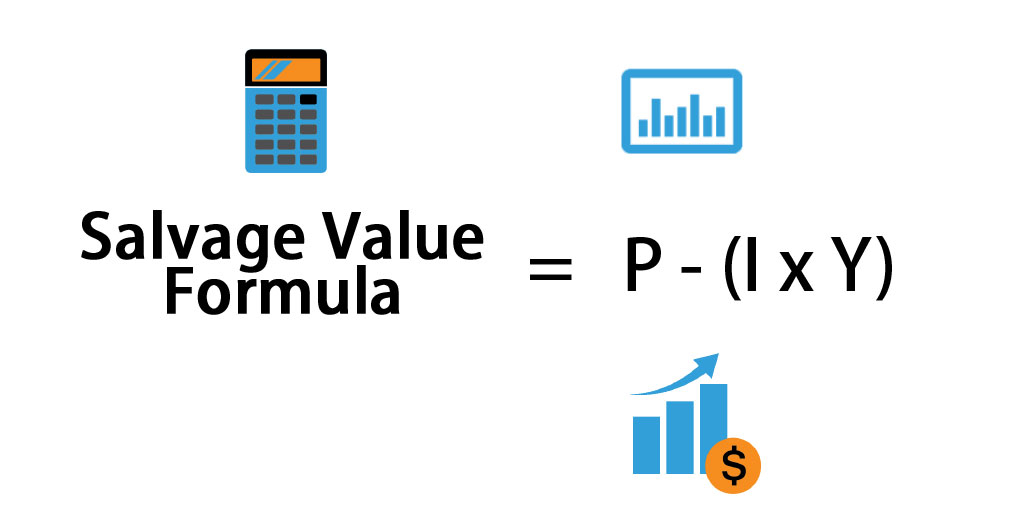

Salvage Value Formula Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator

/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Adjusted Present Value Apv Formula And Calculator

How To Calculate Npv With Taxes Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

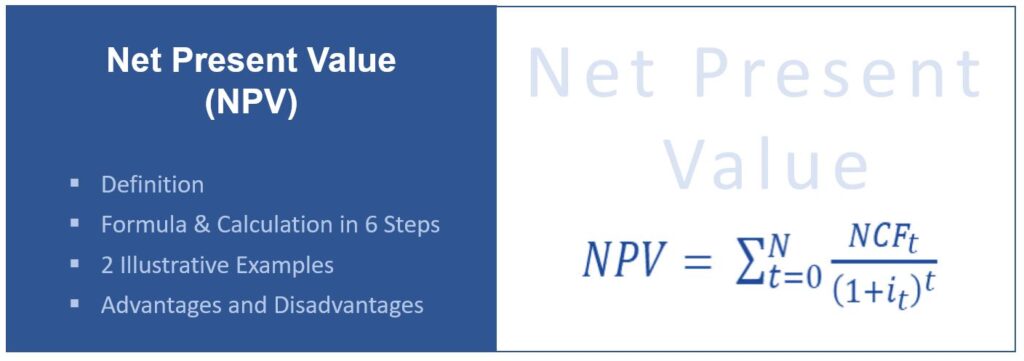

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator

Tax Shield Formula Step By Step Calculation With Examples

Present Value Of Depreciation Allowances Z Download Table

Principles Of Financial Management The Media Vine Financial Management Management Financial